As the twins say, "You're just going to have to recognize you may have some differences-you may provide something for the other one that they don't have. Average total assets: This is the average of all assets the company owned at. In this formula, the elements can read as follows: Net sales: This is the amount of income generated by the company after making deductions, such as sales tax, sales returns, sales discounts and sales allowances.

Total assets turnover ratio formula full#

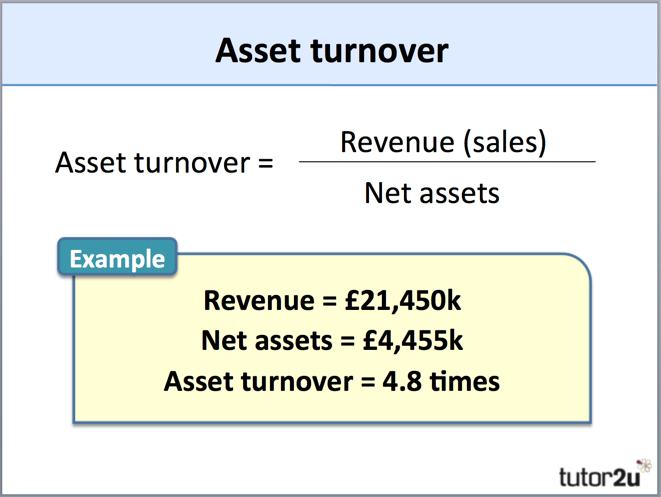

"If you're ready for that, then great-but if you're not, then you're gonna feel stifled."Ĭheck out our full guide to moon compatibility for more information, and remember, two seemingly "incompatible" moon signs can still have a good relationship. Asset turnover ratio net sales / average total assets. Air moons, for example, are "always on the go, so an earth moon will ground you," the twins say. Oppositions can even be good (when the two moon signs are opposite each other on the chart) because these people have something to offer the other in terms of balance, Pennington explains.Īnd as the twins note, another approach when it comes to compatibility is considering how your two elements work together. It can also be pleasant if your moon is " training" your love interest's moon (four signs apart on the zodiac wheel and in the same element), she says. Taking both people's full birth charts into account using synastry is key, and even then, you should always take compatibility measures with a grain of salt.Īll that said, according to Pennington, having the same moon sign as someone can be very beneficial because you'll intuitively understand each other's needs. A higher ratio implies that management is using its fixed assets more effectively.

Reading this ratio along with other ratios will provide a more clear picture about the firm.It's worth mentioning straight out of the gate that if your moon sign isn't traditionally thought of as "compatible" with your love interest's moon sign, that doesn't mean the relationship is doomed. The fixed asset turnover ratio is calculated by dividing net sales by the average balance in fixed assets. The firm may also not be under utilizing its fixed assets. There could be a problem with receivables, as the firm may have a long collection period. The firm may have unsold inventory and may be finding it difficult to sell it fast enough. This is because the presence of current assets in the ratio can lead to misinterpretation of results.Ī low total asset turnover can indicate many problems. The total asset turnover ratio should be interpreted in conjunction with the working capital turnover ratio. The fixed asset ratio is generally not very consistent, because even if the revenue is growing consistently, the fixed assets don’t have a smooth pattern. Similarly, the company is generating $0.71 for every $1 of total assets.Ī high asset turnover ratio indicates greater efficiency.Ī low asset turnover ratio indicates inefficiency, or high capital-intensive nature of the business.Ī low fixed asset turnover ratio could also mean that the company’s assets are new (less depreciation). This results in a figure which reflects how much revenue a company generates, on average, by the assets.

The final stage of calculating an asset turnover ratio is dividing the value of the total sales calculated in step four by the value of total assets calculated in step three. Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed. The total asset turnover ratio will be $1,200,000/($700,000 + $1,000,000) = 0.71Ī fixed asset turnover ratio of 1.71 indicates that the company is generating $1.71 for every $1 of fixed assets. Divide the value of total sales by the value of total assets. Asset Turnover Ratio Net Sales / Average Total Assets When comparing the asset turnover ratio between companies, ensure the net sales calculations are being pulled from the same period. Its average current assets were $700,000, and average fixed assets were $1,000,000. Total Assets include both fixed assets and current assets.Īssume that a company has $1.2 million in sales for the year. Total asset turnover ratio measures how much revenue a company generates from every dollar of the total assets.į i x e d A s s e t T u r n o v e r = R e v e n u e A v e r a g e N e t F i x e d A s s e t s Fixed\ Asset\ Turnover = \frac T o t a l A sse t T u r n o v er = A v er a g e T o t a l A sse t s R e v e n u e Fixed asset turnover ratio measures how much revenue a company generates from every dollar of fixed assets. Fixed Asset and Total Asset turnover ratios reflect how effectively the company is using its assets, i.e., their ability to generate revenue from the given assets.

0 kommentar(er)

0 kommentar(er)